Meritto Loan Connect

Empowering education organizations to connect eligible

loan-seeking students with a variety of loan providers

Your education organization’s virtual loan desk

We understand the frustration: your educational organization does everything right to attract and engage students, yet financial barriers sometimes impede enrollment. Students face a lack of suitable loan options and find themselves shuttling from one bank to another, leading to delayed admissions. This often results in delayed payments and, occasionally, missed enrollment opportunities for your organization.

Meritto Loan Connect streamlines the loan process by quickly and easily connecting loan-seeking students with suitable options directly through their student enrollment portal. By linking students to a broad network of loan providers—including banks, NBFCs, and fintech companies—it enables students to obtain loans faster digitally, ensuring quicker conversions and financial stability for your organization.

The struggle is real for both,

students and education

organizations

Students

- Limited awareness and guidance on loan options

- High interest rates due to limited knowledge

- Limited loan amounts

- Bureaucratic hurdles due to offline processes

- Complex and time-consuming processes

Education organizations

- Ineffective in providing sufficient loan guidance

- Limited loan provider tie-ups

- Administrative burdens of managing multiple tie-ups

- Risk of abandoned enrollments

- Delayed admissions due to payment issues

We understood this and that’s why, we built Meritto Loan Connect

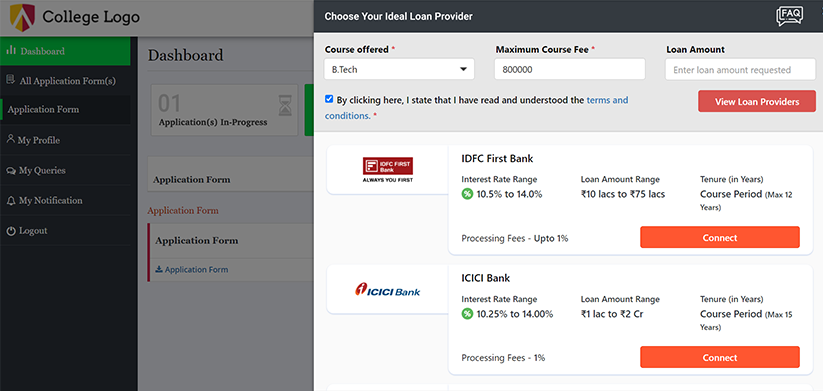

Seamless access for students

Meritto Loan Connect provides a platform for students to gain awareness and guidance regarding education loan options from within the Student Enrollment Portal. Our platform offers comprehensive information and options to connect with the loan provider best suited for them, helping students navigate the loan process seamlessly.

Bridging education organizations with top lenders

Rather than tying up with multiple loan providers individually, Meritto Loan Connect streamlines the process for the organizations by connecting them with a network of loan providers through a single platform. This eliminates the need for setting up multiple loan help desks and simplifies the loan application process for students.

Breaking financial barriers

Meritto Loan Connect addresses the issue of non-affordability for students by providing access to a wide range of loan offerings by various loan providers. This helps students finance their education without facing financial barriers.

Streamlined operations with centralized assistance

Managing tie-ups with multiple loan providers can be time-consuming and labor-intensive for organizations. Meritto Loan Connect simplifies this process by serving as a centralized platform for loan assistance, reducing administrative burden and streamlining operations.

Convert more students faster with lower drop-offs

By offering timely access to education loans through Meritto Loan Connect, organizations can minimize the risk of abandoned carts and delayed admissions. Students can secure loans seamlessly, ensuring smoother admissions processes and reducing dropout rates.

Empower students with seamless access to loans

right from their enrollment dashboard

*Banks and other financial institutions depicted in this flow are for representation purposes only.

Frequently Asked Questions

Get answers to frequently asked questions about Meritto’s admission management software.

Meritto Loan Connect leverages AI-enhanced logic to analyze a student’s profile, preferences, and eligibility, then intelligently surfaces the most suitable loan options from a wide network of banks, NBFCs, and fintech partners. This ensures faster, more accurate matching without the manual hassle.

Yes. Meritto’s AI-backed chatbot and guided workflows simplify loan discovery and application steps by offering real-time assistance, smart nudges, and contextual support. It minimizes confusion and reduces the drop-off rate by ensuring students have help exactly when they need it.

Still Have questions?

Email Us